- All

- Auto Insurance

- Benefits

- Business Insurance

- Case Studies

- COVID

- Cyber

- HIG Academy

- Industry

- Personal Insurance

- Risk Management

- Wellness

The Evolution of Commercial Real Estate

The COVID-19 pandemic brought unprecedented challenges to the global economy, and commercial real estate marketing was no exception. As businesses...

Read More

A Simple Winter Storm Safety Checklist

Winter Storm Safety A major winter storm can last for several days. It can have high winds, freezing rain,...

Read More

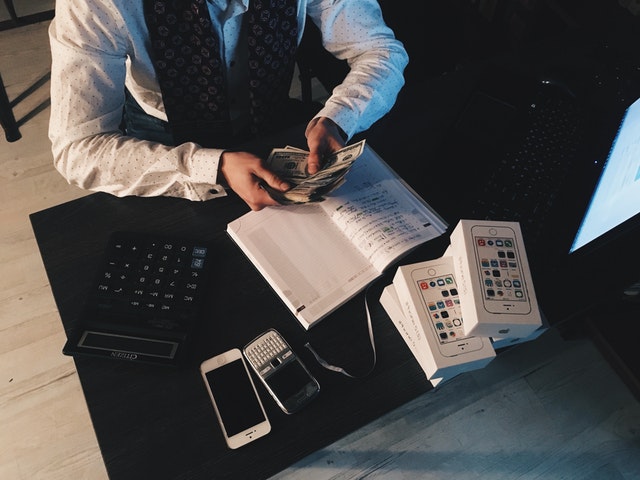

The Top 5 Questions You Probably Have About Business Insurance

When you deal with the insurance industry, chances are that you are going to have a lot of questions that...

Read More

HIG Academy – Flood Premium Increases

HIG President Jon Sharp is here to talk about the recent flood premium increases that went into effect on...

Read More

HIG Academy – Audit Risk Management

HIG President Jon Sharp is back for a second time talking about audits! This time, he's focusing on how...

Read More

HIG Academy – Understanding Audits

HIG President Jon Sharp is here to tell you all about audits, a complex and confusing topic that doesn't...

Read More

HIG Academy – Driver Hiring Criteria

HIG President Jon Sharp is here with a video all about the process of safely hiring new drivers for...

Read More

HIG Academy – Life Insurance

HIG President Jon Sharp is back with another video, this time focusing on life insurance! There are so many...

Read More

HIG Academy – Product Recall

HIG President Jon Sharp is back with a new video, this time focusing on the importance of being ready...

Read More

HIG Academy – Executive Buy-In

HIG President Jon Sharp is here with another informative video, this time about Executive Buy-In! If your business doesn't...

Read More

HIG Academy – Root Cause Analysis

HIG President Jon Sharp is back with another video, this time focusing on Root Cause Analysis. If you're not...

Read More

HIG Academy – Business Flood Insurance

HIG President Jon Sharp is here with a video on business flood insurance. As we move into hurricane season,...

Read More

HIG Academy – Personal Flood Insurance

HIG President Jon Sharp is back with a video on personal flood insurance! As we move through hurricane season,...

Read More

HIG Academy – The Hard Market

HIG President Jon Sharp is here with another video, this time explaining what the upcoming hard market will mean...

Read More

Live Well, Work Well: COVID-19 Vaccination FAQs

Hopefully soon, many businesses will be returning to work here in the state of NJ.

Read More

HIG Academy – Returning to Work

Hopefully soon, many businesses will be returning to work here in the state of NJ.

Read More

HIG Academy – Online Enrollment Tools

Online Enrollment Tools have made massive leaps forward in the last few years.

Read More

HIG Academy – Riots and Vandalism

Sadly, our entire country is seeing both riots and looting. Some of you are probably wondering if your policy will cover you.

Read More

HIG Academy – What Is Your Reserve?

HIG President Jon Sharp explains what exactly your Open Reserve is and how they can cost you more money than you might think

Read More

HIG Academy – Calculating Your MOD Factor

HIG President Jon Sharp is here with another video featuring some useful advice that can help you better understand your MOD factor and how it’s calculated.

Read More

HIG Academy – Workers Compensation Update #4

HIG President Jon Sharp is back with another video that helps provide more education on Workers Compensation!

Read More

HIG Academy – Workers Compensation Update #3

HIG President Jon Sharp is back with another video that highlights new Workers Compensation guidelines!

Read More

HIG Academy – Workers Compensation Update #2

HIG President Jon Sharp is back with another video that highlights new Workers Compensation guidelines!

Read More

Matthew Bagell of BJL on COVID-19 and the Stock Market | HIG COVID-19 Series

HIG President Jon Sharp spoke with Matthew Bagell, the owner of BJL Wealth Management LLC on what effects COVID-19 will continue to have on the stock market.

Read More

Jeff Sallade and Ken Guzzardo of 3DPT on Tips For Working From Home | HIG COVID-19 Series

HIG President Jon Sharp spoke with Jeff Sallade and Ken Guzzardo of 3DPT on some physical changes we can implement to help improve our health and wellness while working from home!

Read More

Angela Barnshaw of AGENT06 on COVID-19 and the Housing Industry | HIG COVID-19 Series

HIG President Jon Sharp spoke with Angela Barnshaw of Agent06 about COVID-19 and the effects it's been having on the housing industry.

Read More

Tom Kleinhans of Bowman LLP on COVID-19 and the Accounting Industry | HIG COVID-19 Series

HIG President Jon Sharp spoke with Tom Kleinhans of Bowman & Company LLP about how COVID-19 is affecting the accounting industry.

Read More

Paul Boyer of Ancero on the effects of COVID-19 on the Technology Industry | HIG COVID-19 Series

HIG President Jon Sharp spoke with Paul Boyer of Ancero about the effects that the coronavirus is having on the technology industry and infrastructure in our area and across the country!

Read More

Brian Blaston of HIG on COVID-19 and the Insurance Industry | HIG COVID-19 Series

HIG President Jon Sharp spoke with our own Brian Blaston about the effects of COVID-19 on the insurance industry.

Read More

Frank Plum of Workplace HCM on the effects the Coronavirus on the Payroll Industry | HIG COVID-19 Series

HIG President Jon Sharp speaks with Frank Plum of Workplace HCM about the effects that the coronavirus is having on the payroll industry as well as other small businesses in our area!

Read More

Jason Wolf of WCRE on the effects of COVID-19 on the Real Estate Industry | HIG COVID-19 Series

HIG President Jon Sharp spoke with Jason Wolf of Wolf Commercial Real Estate about the effects that COVID-19 are having on Real Estate and other types of businesses in our area!

Read More

Understanding Your Experience Modification Factor | HIG Academy Webinar

HIG’s own Joe Haggerty hosts this informative webinar all about your Experience Modification Factor, as a part of our HIG Academy Webinar series!

Read More

Proactive Hiring Practices | HIG Academy Webinar

John Baldino from Humareso conducts this webinar for proactive hiring practices—and the differences in proactive and reactive hiring! Enjoy this video and please feel free to share it if you think the information provided could be beneficial to your audience!

Read More

5 Tips for Embracing the New Work-Life Balance

Striking balance in isolation requires an organizational approach. Simplify, segregate, and synthesize.

Read More

Nikitas Moustakas of Moustakas Nelson on the effects of COVID-19 on the Law Industry | HIG COVID-19 Series

HIG President Jon Sharp spoke with Nikitas Moustakas of Moustakas Nelson, LLC on the effects of COVID-19 on the Law Industry

Read More

Business Flexibility Can Be An Asset In Trying Times

If you continually run through multiple scenarios in your mind, subconsciously you will develop solutions that can be implemented quickly should the need arise.

Read More

Disaster Prepardness Is Essential For Business

Although the collective result of an event may indeed be a disaster by definition, at an individual level, proactive steps can be taken to reduce the likelihood that an event is as severe for you as it may be for others.

Read More

5 First Steps to Take When Your System Gets Hacked

If you have not yet experienced a ransomware virus, the following tips will be invaluable to you in minimizing your chances of becoming debilitated by any future infection and will put you in a stronger position to handle an attack should you be targeted again in the future.

Read More

Regulations Can Save Your Business Money

Safety programs stemming from the guidelines which are set forth in many regulations can be used as a proactive measure to keep your equipment and employees safe.

Read More

Disaster Specific Insurance Is Essential for Your Business

Do you know what types of disaster insurance you may need (or be required to have)? If not, you may want to pick up the phone and make some inquiries.

Read More

What’s The Deal With Flood Insurance?

Flooding can happen at a moments notice and it's important that you have the protections in place to safeguard your business against it.

Read More

The Value of Disaster Preparedness for Your Business

Disasters can have a huge impact on your business. If you aren’t prepared, the damage could be catastrophic, leading to slowed growth or even a complete shutdown of your company.

Read More

Why Proactive Safety Programs Are Better than Reactive Ones

Does your company have a need for safety programs? Most do. Are you following all applicable regulations and taking some additional steps on your own?

Read More

How To Prevent Distracted Driving

Distracted driving has become an epidemic over the past decade, with more and more people shifting focus away from the road and onto their phones or mobile devices. Businesses can do more to help prevent this from occurring!

Read More

6 Attitudes That Lead to Outstanding Customer Service

Companies can often overlook how to improve things like there customer service, so here's a few easy tips that can help make yours outstanding!

Read More

HIG Academy – Workers Compensation Update #1

COVID-19 has caused significant changes across the board within the insurance industry.

Read More

John Baldino of Humareso on the effects of COVID-19 on the HR Industry | HIG COVID-19 Series

HIG President Jon Sharp spoke with John Baldino of Humareso about the effects that the coronavirus is having on the HR Industry in our area and across the country!

Read More

Anthony Mongeluzo of PCS on the effects of COVID-19 on the IT Industry | HIG COVID-19 Series

HIG President Jon Sharp spoke with Anthony Mongeluzo of PCS about the effects that the coronavirus is having on IT businesses and infrastructure in our area, and across the country!

Read More

How To Protect Your Business From A Cyber Attack

Technology has changed the business world. In creating social platforms like Slack, Trello, & LinkedIn, companies can store and share projects and information.

Read More

How To Create A Vision Plan For Your Company | Jon Sharp

Consider how important creating, implementing, and maintaining a vision is for the future of any company.

Read More

The Unseen Danger of Cyber Liabilities

When it comes to cyber liability insurance, the key is to know exactly what you’re looking for. Consider the following facts before making a final decision.

Read More

ACCU – How One Woman Created The #1 Staffing Company In Our Region

When it comes to staffing solutions, the key is to know exactly what you’re looking for. ACCU is your one-stop solution for filling positions easily and quickly.

Read More

How to Make Your Auto Insurance More Affordable

When it comes to affordable auto insurance, the key is to know exactly what you’re looking for. Consider the following facts before making a final decision.

Read More

Types of Cyber Security Attacks

From social networking to building a media empire, it is impossible to run a successful business in today’s world without utilizing the internet in some form.

Read More

Tax Cuts and Jobs Act: Dec 2018

The IRS issued an extension for furnishing the 1095-C and 1095-B forms to Individuals to March 2, 2018. The deadlines for filing with the IRS remain unchanged.

Read More

Protect Your Business Against Claims Of Negligence

We put in the time and effort to make sure that we know the requirements to deliver flawless products/services to our clients that exceed their expectations.

Read More

How to prepare your house for the holidays

At Hardenbergh Insurance, we want to make sure you're well prepared this holiday season for all of your festivities and holiday gift giving.

Read More

If I am rear ended, does my insurance go up?

An auto accident with or without responsibility on the driver is an unpleasant situation considering all its side-effects. This includes dealing with Insurance.

Read More

Motorcycle Basics: What you need to know before you ride

May is Motorcycle Safety Awareness Month and with the beautiful weather, we want to ensure your time on the road is safe for you and for others.

Read More

Is Sitting the New Smoking? Why You Need To Be More Active In The Office

Technology has brought comfort into our lives, but has its flaws. Using phones, computer software, and the internet have drastically reduced physical activity.

Read More

Must I wait to file my taxes until I receive the 1095-B or 1095-C forms?

Taxpayers may not get a Form 1095-B or Form 1095-C by the time they're ready to file tax returns. These forms assist in preparing returns, but are not required.

Read More

How to prepare for retirement

Retirement –the grey area after a long career. To some people it marks the beginning of a period of uncertainty, to others, it's a time filled with possibility.

Read More

How to prepare your home for winter

If you’ve stepped outside the past few days, you’d understand that it’s blistering cold out. The polar vortex is upon us and winter has yet to officially begin.

Read More

How To Safely Walk Your Dog In The Summertime

We’re at the peak of summer, and like most people, you’re probably sweating from the heat. Did you know that this could also be the case for your canine?

Read More

Owning a Business and Employee Healthcare Premiums

Owning a Business and Employee Healthcare Premiums. How much should the business owners pay for the health care premiums for their employees?

Read More

How to Maximize Sales This Holiday Season

For retailers, the holiday season translates into a high volume of people shopping. This usually results in great sales and even better revenue.

Read More

Property Insurance Coverage: Tree Falling On Neighbor’s Yard

We've all heard the story of that time a tree fell on someone's house, yard, or car, but does it actually happen? Yes and it happens more often than you think.

Read More

Productivity Hacks for Small Business

Whether you work for or own a small business, it comes with its own set of pros and cons. Being a part of a Small Business is no small task.

Read More

What are an Employer’s responsibilities for Workers Compensation?

What Employer’s responsibilities for Workers Compensation? Employers are required to do the following to comply with workers’ compensation insurance laws.

Read More

Insure Your Inventory In Case Of Disaster

If you work in direct sales, then chances are you have an inventory of different items with you. Depending on the industry that you’re in, the items can vary.

Read More

The Benefits of Having an Umbrella Policy

An umbrella policy is an additional liability insurance coverage above and beyond the limits of the insured's regular insurance for home, auto or watercraft.

Read More

What is the difference between an Employee vs independent contractor?

Whether you're an employer or an individual looking for new options, we want you to understand the difference between an employee vs an independent contractor.

Read More

What is an OSHA DART Rate?

DART rate means days away, restrictions or transfers. The higher number of incidents requiring days away, restrictions or transfers, the higher the DART rate.

Read More

Power Washing Tips And Precautions

There are some cases where you’re faced with stains that not even your best cleaning equipment can manage. In those cases, power washing can be the solution.

Read More

If I am Injured in a Car Accident Who Pays For It?

There can be several scenarios of a person getting injured in a car accident, whether the driver of a car gets injured, a passenger, or even a bystander.

Read More

What are the basic steps to comply with OSHA?

There are five steps you can take to have a safety program that achieves OSHA compliance, reduces accidents, and ultimately reduces workers’ compensation costs.

Read More

Types of Insurance Every Small Business Needs

A small business is a privately owned and operated company with limited size and revenue earnings depending on the type of industry it caters to.

Read More

What You Need to Know About Auto Insurance

Auto Insurance is an important responsibility in order to protect a person from various risk factors, compliance with laws, regulations, and poor drivers.

Read More

What Is Key Person Insurance And Why You May Need It

Key Person Insurance is an insurance policy for a business to compensate itself for the financial losses arising from the event of death or extended incapacity.

Read More

What you need to know about lighting your home this holiday season

While lights give the house a warm and welcoming look, there is a possibility of a few miscalculations and carelessness. Here are a few tricks and tips.

Read More

Equifax Security Breach: Have You Been Affected?

Cyber liability is critical for your business. With the recent security breach of Equifax, which holds socials, credit cards, etc, millions have been affected.

Read More

Is my business required to offer benefits to my employee’s spouses and/or dependents?

Cyber liability is critical for your business. With the recent security breach of Equifax, which holds socials, credit cards, etc, millions have been affected.

Read More

Summer weather calls for adventure

Kids are out of school, college is on hiatus, and it’s time for some fun in the sun. With a wide variety of activities to pick, how do you choose what to do?

Read More

What You Need To Know About Cyber Security

This is the Digital Age. Roughly 3.8 billion people use the Internet, with 78.2% of the US population (roughly 252.6 million people) having Internet access.

Read More

Tips For New Business Owners

Starting a new business is risky, but has benefits. When owning a business, you will be a decision maker. You are the one in control of growing your business.

Read More

What is a variable hour employee?

A variable hour employee is one who, upon hiring, the employer is unable to determine whether or not the employee will regularly work 30 or more hours per week.

Read More

IRS Released 2018 HSA Limits

The Internal Revenue Service has released the 2018 parameters for qualified high deductible health plans (HDHP) and health savings account (HSA) contributions.

Read More

You Own A Boat. What Now?

Congratulations on buying your first boat! With all major vehicles, there are things that you’ll need to know in order to make the most of it.

Read More

Tips On Finding The Perfect Apartment

So you're ready to move out but you aren’t quite sure where to go. There are several things you need to consider. Perhaps you need to cut back on expenses.

Read More

How to make your home secure

The world is a dangerous place. If it isn’t the threat of a home invasion when you’re out grocery shopping, it’s waking up to find that your kitchen is on fire.

Read More

What you need to know about your starter home

You’ve inked that final contract, paid your closing costs, and you’re moving in. You’ve purchased your first home! For many, this is a significant milestone.

Read More

The tax penalty for not having health coverage in 2015 is the greater of 2% of income or $325 per person. What is the maximum amount of income that you would be required to pay the 2% penalty on?

The tax penalty for not having health coverage is the greater of 2% of income or $325/person. What is the maximum amount you would pay the 2% penalty on?

Read More

Why Your Business Needs Crime Insurance Coverage

Owners need to take necessary steps in order to ensure the business’s survival and success, irrespective of the size, scale and industry of the company.

Read More

How To Select An Insurance Broker

Today’s competitive marketplace is forcing many businesses to examine prices they pay for their products/services and the companies where they buy them from.

Read More

How To Manage Your Business Problems

In business, it’s easy to spot the problems, but management is deciding how to solve them. Most are not equipped to take on difficult situations and employees.

Read More

How To Make Your Car Last Longer

Purchasing a car is a financial investment and you want to maintain it for a long time. Keep your car running with proper care to improve the durability.

Read More

How To Hire Your First Employee

Finding your first employee is a very special experience in the life of an entrepreneur. If you're starting 2017 off with new employees, congratulations.

Read More

Why Is Your OSHA DART Rate important?

Like your incidence rate, which is based on how many incidents per year per 100 employees, your DART rate shows your company's performance in workplace safety.

Read More

For the 9.5% affordability test, use the Box 1 total on the individual’s W-2, but does that Box 1 include FSA contributions made by the employee?

For the 9.5% affordability test, use the Box 1 total on the individual’s W-2, but does that Box 1 include FSA contributions made by the employee?

Read More

How is my Workers Compensation experience mod factor calculated?

The process of calculating the experience modification factor is complex, but the underlying theory and purpose of the formula is straightforward.

Read More

How to Help Your Business and Municipalities In The Event of a Hurricane

With the impending hurricane season upon us, get a better understanding of how to protect your business, community, and people in case of a natural disaster.

Read More

What are the minimum amount of hours employees have to work to be eligible for health benefits?

What are the minimum amount of hours employees have to work to be eligible for health benefits? Find the answer at the Hardenbergh Insurance learning center.

Read More

How is Workers Compensation premium determined?

Your workers’ compensation insurance premium is based on payroll, averages for your industry and claims experienced over a three-year period.

Read More

How do the employer mandate penalties work if an employer does offer coverage?

A mod factor greater than 1.0 is a debit mod, which means that your losses are worse than expected and a surcharge will be added to your premium.

Read More

Halloween Safety Tips

Children and adults enjoy activities like trick-or-treating, Halloween parties, creative decorating, pumpkin carving to make jack-o'-lanterns, bonfires etc.

Read More

Hit a Pothole? Is it Covered?

It is a formal request to an insurance company requesting a payment towards the claimant party based on terms & conditions of the active insurance policy.

Read More

How can I reduce my Workers Compensation costs?

Workers’ compensation is designed to recompense employees for injuries/illnesses they suffer while on the job. More claims drive up workers’ compensation costs.

Read More

How a Claim Differs from a Suit

It is a formal request to an insurance company requesting a payment towards the claimant party based on terms & conditions of the active insurance policy.

Read More

Does it make a difference if a group is a large or small group when determining whether employees are eligible for a subsidy?

A person is not eligible for a subsidy if they are eligible for coverage through an employer and this meets the coverage and affordability requirements.

Read More

How does my mod affect my premiums?

A mod factor greater than 1.0 is a debit mod, which means that your losses are worse than expected and a surcharge will be added to your premium.

Read More

How do the employer mandate penalties work if an employer does not offer coverage?

In 2015 the “no offer” penalty will apply if an employer does not offer coverage to at least 70% of full-time employees and their dependents.

Read More

How to Be Prepared for a Disaster in Your Business

What if something went wrong in your business? Do you know what needs to happen in case of an emergency? You need to ask yourself this as a business owner.

Read More

How is a DART Rate Calculated?

To calculate the DART rate, you need to find out the total number of injuries that required at least one day away from work or restricted or transferred work.

Read More